A fund for every life stage and risk profile – the Rutherford Funds Explained

In this edition of our series on the Rutherford Funds Explained we feature the Rutherford Cautious Balanced portfolio, focussing on the basic structure of the fund, how it works to offer consistent inflation beating returns over the long term, with minimal volatility through the market cycles, and which clients it is specifically developed for.

Key Features and Objectives of the Rutherford Cautious Balanced Portfolio

- The portfolio is a Fund of Funds comprising a focussed blend of up to 10 top quality unit trusts, each managed independently

- It is designed to achieve returns of inflation +2% over the long term, meaning that your investment can grow consistently even while withdrawing income

- The risk is Low-to-Moderate with a higher exposure to bonds than equities

- The fund is Regulation 28 compliant, requiring that it is managed in compliance with the prudential investment guidelines that apply to retirement funds in South Africa

Strategic Asset Allocation

The Rutherford Cautious Balanced strategic asset allocation is based on more than 100 years of statistical data and long-term asset class returns. Our objective is to achieve the target returns with the lowest possible risk – otherwise known as risk adjusted returns. Knowing how each asset class has performed in the past enables us to allocate the optimal weighting per asset class. Consequently, in order to offer the best risk adjusted return within its mandate of inflation +2%, the Rutherford Cautious Balanced fund is composed of a higher proportion of bonds and cash (± 70%) relative to equities (± 30%)

Market Outlook

On a quarterly basis, the Investment Committee gauges the current risks in the economic environment, both in South Africa and globally, and may adopt a slightly more defensive posture than the ideal long-term Strategic Asset allocation would indicate. In our Market Outlook we look at forecast global economic growth and risk factors such as geopolitical tensions. Currently the wars in Ukraine and the Middle East, and the US elections need to be considered.

Macroeconomic View

Our macroeconomic view consists of analysing economies and their strengths and weaknesses. This process is determined by inflation rates, interest rates, debt to GDP ratio, currency strength or weakness, price to earnings ratio, monetary policy, fiscal policy, geopolitical risks, etc. By analysing these aspects of the global economy, we can identify longer term opportunities. Every quarter the investment team reviews the macroeconomic view and rebalances the fund.

Tactical Asset Allocation

Tactical asset allocation is an active management portfolio methodology that tweaks the percentage holdings in various asset classes to take into account current and expected market conditions. The tactical asset allocation within each underlying fund remains the responsibility of our chosen fund managers, so our Cautious Balanced portfolio benefits from the different views and perspectives of each team of experts.

Current Asset Allocation in the Rutherford Cautious Balanced Fund

Current Holdings in the Rutherford Cautious Balanced Fund

The Selection Criteria for our Fund Managers

- The blend of managers must be able to achieve the fund benchmark (e.g. CPI+2%)

- The blend of funds must have the appropriate asset class mix for the targeted return

- The managers must have strong investment allocation frameworks and consistent processes

- The managers must have outstanding long-term performance track records, proving their ability to achieve the applicable benchmark through the market cycles

- The funds all have above average upside capture and downside protection ratios

Investment Styles

One of the key objectives of the Rutherford Cautious Balanced portfolio is to achieve the target returns but with low volatility. This provides investors with a more consistent and smoother investment experience and has been proven to encourage investors to take a longer view of market conditions and thereby achieve better investment outcomes. We therefore select funds which have uncorrelated management styles, so that our Cautious Balanced portfolio benefits from varying market cycles and differing management approaches.

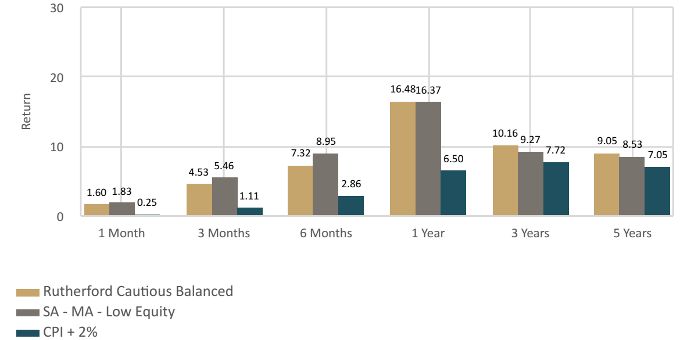

Rutherford Cautious Balanced Fund 5 Year Performance as at 30 September 2024

The Rutherford Cautious Balanced Target Market

This fund is most suitable for investors that are aged 55 and older, including retired individuals, or those investing a large lump sum and are seeking to lower market risk. The Rutherford Cautious Balanced portfolio is a Low-to-Moderate risk fund, which has low volatility and provides consistent inflation beating returns to preserve and grow your wealth over the long term. It is ideal to provide steady returns while drawing income in retirement. It is typically applied in retirement products such as retirement annuities and living annuities as well as endowments.

Our track record shows that the Rutherford Cautious Balanced fund has proven itself as a "safe haven" during times of economic uncertainty and as such can find a place in many clients’ investment portfolios.