The inflation rate affects nearly every aspect of economic life, from interest rates to home loans, to the rate the government pays on our national debt. The price increases we feel when buying food, clothes or paying school fees and medical expenses are driven by our inflation rates.

In the late 1970’s and 1980’s inflation was high worldwide, but rapidly cooled so that by the 1990’s most developed countries enjoyed low inflation rates of below 3%. In South Africa however, we suffered from much higher inflation for much longer. It’s only in the last 15 years that South African inflation has become more stable and subdued after a concerted effort by the South African Reserve Bank (SARB)

The Reserve Bank is now targeting 3% inflation. Is this really feasible?

Since 2017 the SARB has targeted the 4.5% midpoint of the official 3% - 6% inflation target range. Over the last few years the SARB has called for the target to be lowered to 3% to make South Africa more competitive and to ensure permanently lower inflation and interest rates. It has stepped up that campaign in recent months, as inflation has trended lower to 3% or less, making it easier to set a lower target with less economic pain.

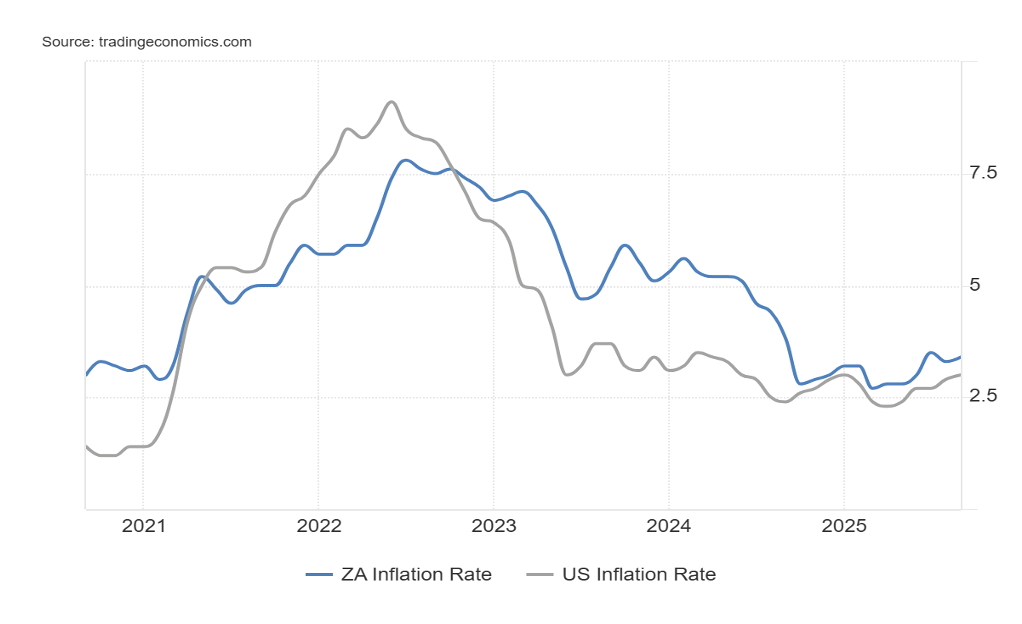

As South Africans, especially those of us who have been in the workplace for a few decades, we make all financial decisions with the assumption that inflation will be a significant factor – because for the last 50 years it definitely was. However, as the chart below shows, inflation in South Africa is now broadly in line with inflation in the United States and has been so for the past 5 years.

While periodic shocks to the system can’t be avoided, much inflation is driven by expectations. If people or companies anticipate higher prices, they build these expectations into wage negotiations and contractual price adjustments (such as automatic rent increases). This behaviour partly determines the next period’s inflation. Once the contracts are exercised and wages or prices rise as agreed, expectations become self-fulfilling. And to the extent that people base their expectations on the recent past, inflation would follow similar patterns over time, resulting in inflation inertia.

So, fixing the inflation target at 3% will go a long way to creating behaviours that keep it there.

How will lower inflation benefit South Africa?

Nearly all economists advise that keeping inflation low contributes towards economic stability, which in turn encourages saving, investment, economic growth, and helps maintain international competitiveness.

Consumers will benefit from lower interest rates on car and home loans and more stable costs for household expenses. Entrepreneurs will be able to plan and fund business expansion with lower costs and more certainty.

Reserve Bank Governor Lesetja Kganyago emphasised the benefits of a lower inflation goal, saying that over the next decade it could save the government as much as R900 billion in interest payments on the government debt. Foreign investors have responded positively to the SARB moves. The prospect of lower inflation has increased their willingness to fund government debt, with expectations of capital gains.

Another aspect of lower inflation is that the Rand should tend to become more stable. The fact that South Africa has had much higher inflation than the United States or the United Kingdom for most of the last 50 years has been a decisive factor in the Rand weakening from parity with the US$ in the early 1970’s to over R17 to the Dollar today. If South African inflation settles at similar rates to the United Kingdom and the United States, the relentless headwind to Rand stability is removed.

Lower South African inflation and a more stable currency would be very good news for investors, consumers and business.