Tariffs and Trade Wars

Living at the bottom of Africa does have its advantages. We tend to be slightly less impacted by global economic crises, and the Rand often performs the role of shock absorber to our investment portfolios. We are living through massive changes in the international political order and the US$ dominated financial system is rapidly evolving, yet South African markets are weathering the storm so far.

The Donald Trump Presidency is determined to reset how global trade is conducted, and to usher in a system which they believe will be fairer to America. Abandoning the free-market capitalism of the past 80 years, the United States has adopted an economic policy known as mercantilism. The tariffs on imports combined with subsidies and legislative support for domestic industries are designed to reduce imports, reinvigorate the US manufacturing base and increase exports.

The question is why would the US choose to embark on these risky policies? The experts inside the Trump administration believe that even though the US has enjoyed remarkable prosperity over the last few decades, the fundamentals of the American economy are fragile:

Financial soundness - The US national debt has ballooned to $36 trillion which is unsustainable, and over $10 trillion of this needs to be rolled over in 2025. The budget deficit is now 7% of GDP which means that this huge debt just keeps getting bigger. A financial collapse is no longer out of the question.

National security – During the Covid lockdowns the US found that many essential products were simply unavailable because over the last 30 years it had outsourced much of its manufacturing to lower cost countries like China and Vietnam. The Ukraine war, where the US is unable to quickly replenish munitions and equipment sent to Ukraine, has hammered home the lesson that you can’t defend yourself if you don’t have a strong manufacturing base.

Since taking office President Trump has imposed a raft of tariffs on most countries across the globe. Many of these measures are part of Trump’s trademark tactic to gain leverage in negotiations, and have been quickly reduced. However, the main focus of the US government’s policies is the China - US trade relationship.

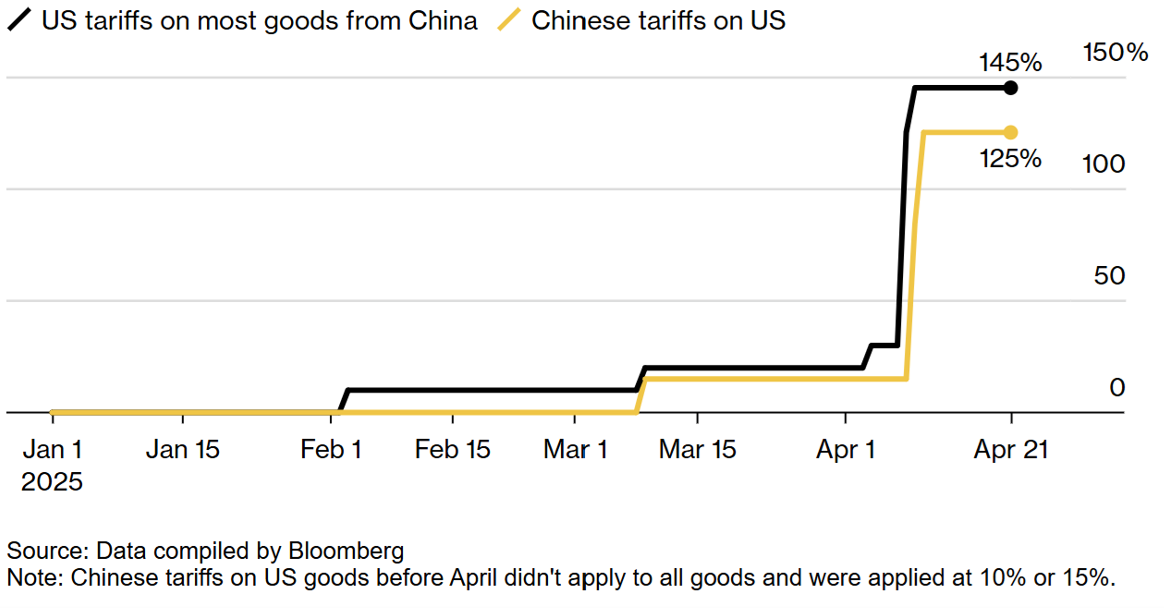

The first tariffs and trade restrictions were levied on China in 2016. Over the past few weeks the US has increased Chinese tariffs to an astounding 145%. This has sent shockwaves through the global economy, because China is by far the world’s largest manufacturer and many critical supply chains are entirely reliant on China. The US is likely to slide into recession as the uncertainty created by these tariffs take full effect.

This chart shows the tariffs imposed on China in 2025 and the retaliatory measures taken by China on the US. On Monday 12th May these were put on hold for 90 days with only a blanket 30% tariff on China and a counter 10% tariff on the US remaining.

Frequent tariff announcements and backtracking have already created enormous volatility in global equity and bond markets, but the full effects of these high trade barriers and policy uncertainties will only be felt in the months ahead.

South African investors are, to a certain extent, largely insulated from the impact of the global trading turmoil. This is because many of the biggest JSE–listed companies operate abroad and earn significant revenue outside of South Africa in foreign currencies, usually in US$. In fact, over 60% of the revenue of companies making up the JSE All Share Index is derived from overseas, while less than 40% comes from within South Africa.

Most South African unit trusts comply with Reg 28 of the Pension Funds act which restricts the investment of retirement funds, limiting exposure to specific asset classes to protect members' savings from excessive risk, and ensuring a high degree of diversification. Under this regulation asset managers are allowed a direct offshore allocation of up to 45% which further diversifies South African investors' portfolios.

Choosing a multi-asset balanced fund is an ideal way to ensure that your investments are diversified across asset classes and derive returns from companies around the world. Our Rutherford model portfolios are a strategic blend of world class South African and international unit trusts, designed to achieve consistent targeted inflation beating returns with the lowest risk.

Our model portfolios continue to prove that our investment philosophy works, delivering consistent returns for our clients through the market cycles.